August 9

Stock charts provided by Tradingview.com

Entries charts provided by IBKR.com

Trades:

Trades Taken: 1

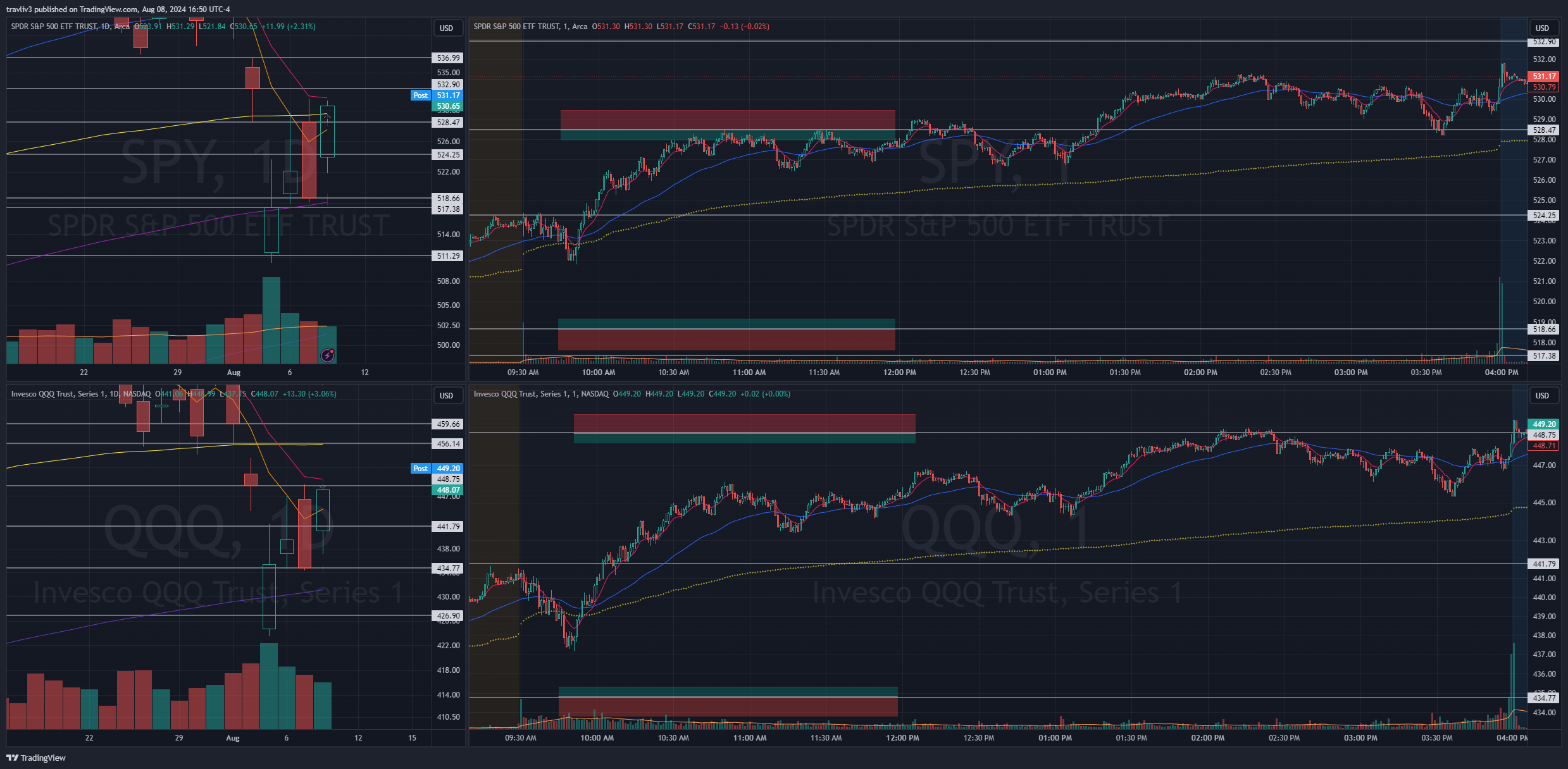

SPY

Plan: FRIDAY ALERT: Big week in the markets, but the trade plans have been solid as one can see. Will likely not trade this morning following such a stellar week, but I always make plans to be prepared.

Steady sell off during premarket after futures market was gapping up most of the night. Markets trying to find their first higher low as I write this about 9 am, right near yesterday’s end of day VWAP.

For SPY, strategy dictates a short into previous close and 9 ema IF AND ONLY IF there is enough distance. With no distance, I would be looking for a potential remount long of this level. For a long, the 526.35 area is interesting, it was a nice hold area yesterday around where the 5 ema was. The long I really like is Wednesday’s gap of 518.66.

Result: Both markets opened smack between the 5 and 9 ema’s on the daily charts. I started on SPY 531 Puts on the first flash up, averaging into the first test of the 9 ema and previous close area. All it took was one red candle to send the action back to morning lows for another beautiful first reaction trade!!! The price action came back up to test the level again, working with even more follow through, and who knows, could keep going. The trade very well may continue to work in the direction I wanted it, but like everyday, I’m done on first reaction. Consistency is key!

Lesson: Friday’s are normally, in my opinion, the most emotional day in the markets. That is not something I want to be apart of. I want to be in and out on Friday’s, especially after such a great trading week. Being done by 9:34 am (6:34 am my time) on a Friday after a clean first test means more to me than sticking around for a home run. If you haven’t been able to tell by now, I go for base hits everyday!

QQQ

Plan: For QQQ, I like the previous close into the 9 ema, but risk is a bit wide for my taste. Notice the distance between those two levels on the chart is almost 3 points. The long is not as clean as SPY, overall SPY has cleaner levels this morning.

Result:

August 8

Trades:

Trades Taken: 1

SPY

Plan: Current premarket highs for both markets are sitting just under the end of day vwap (actually, vwap is same area for two days in a row, interesting). May take a stab short at these inner levels if we have distance at the open. Other levels of interest for SPY short are marked, each having significant distance between levels. For a long on SPY, I like the previous close.

Very clean test on both markets of the first short level in premarket. This is an area I will watch, if traded, small size due to closeness. Really like distance into trade boxes today, may be a later morning trade.

Result: Both markets opened right under the first short level I was watching. Too close for comfort to take for me considering the wide ranges we have been experiencing. I did not have major support marked where we bounced, so I was patient for a proper trigger and took SPY 529 Puts for a nice trade on the first reaction.

Lesson: I actually missed the first proper entry. I took a chase on the first entry because I was away from my computer at the right entry time. I caught myself in the moment doing this, realized I did not take a proper entry, and got out right away. Check out the entries chart to see this, can you tell the difference between the entries? I then got back in properly to strategy, and what do ya know, it worked nicely when doing it properly.

Perfection is impossible, but I do strive for excellence. We all make mistakes from time to time. I noticed my mistake immediately, and corrected it. Being hard on myself this morning about that mistake, but glad to see I got refocused and got right back to the trade I was aiming to take. It has taken years for me to catch these mistakes in the moment and learn from them quickly enough to get refocused.

QQQ

Plan: Similar plan to SPY. End of day VWAP is close, but interesting. Previous close for a long, and a previous gap/high of day 448.75 area for a short. I anticipate range again today.

Result: No true trigger for the levels I was prepared and willing to trade.

August 7

Trades Taken: 2

SPY

Plan: 532.90 gap fill for a short is very interesting. It appears SPY and QQQ will hit gap fills at different times, so may be a bit tricky as trading the markets together is an advantage. First gap to test and I’ll likely take it if it has distance. For a long, previous close has vwap and yesterday’s open in risk, nice protection with distance.

Result: Both markets opened very close to the 5 ema on the daily chart (100 ma for SPY as well). First trade of the day was on QQQ, see below for details. Second trade of the day was on SPY, a remount of the moving averages on daily chart after pushing past them. Check out the SPY 529 calls to see how I nailed the attempted remount. Not looking for follow through, just a reaction. Don’t know what a remount trade is? Check out types of trades.

QQQ

Plan: Similar to SPY, the QQQ gap fill at 448.75 is the first short I like, with a reset short at 456. For the long, previous close, but I like SPY better for a long.

Result: Opening right at the 5 ema we pushed straight up for 3 minutes into entry area of gap fill short trade outlined. I executed the QQQ 450 puts. Knowing the 5 ema on daily was right under the action, had to be quick on this one, and man did I read that like a book! Nice pay out on first move into the 9 ema on intraday after nailing the entry!

August 6

Trades Taken: 4

SPY

Plan: For SPY, I like previous close for a long. Is also a previous range and end of day vwap. For a short, I like pm highs into yesterday’s high of day. Two other levels (friday’s low and close) as possible reset trades.

Yesterday was a massive move, both the gap down and recovery. Option premium is higher, risk is increased. Another day of trading small and close to level until I see some calmness in the market as we are extremely volatile.

I’m watching previous close on both markets quite heavily. While strategy dictates to take a long into the level while above it, I need distance. I’m prepared, and half expect, a failure of previous close which brings up a potential head bump opportunity.

Result: Last three minutes of premarket a sharp move down. I executed on calls first minute after seeing we scooped up quickly after the quick sell off in last three minutes of premarket. SPY 516 calls for a nice quick move (look at that beautiful top exit!). Approaching 10:00, SPY was squeezing into short level, I started with SPY 524 puts and got instant reaction and first target into the 9 ema on the intraday. Nice 3rd trade of the morning on this wide range day. See below for my 2nd trade on the day on QQQ.

Addition: A rare afternoon trade for me, I took SPY 530 puts as we pushed to extremes today, right into moving averages for a nice opportunity to average on a trade, something I was looking to do today. I got the averaging practice I was looking for, and paid out handsomely as the trade really picked up. One may look at a trade like this and see how much is left on the table. I see consistent playing of peaks of valleys even on a volatile day. Mindset and perspective are everything! Nice rare afternoon trade! Look at that move AFTER the trade. Certainly was playing the right level!

QQQ

Plan: For the long, I like previous close into 432.62 range. Certainly wide, but also has end of day VWAP in risk. For a short, I like a stab at yesterday’s high of day into Friday’s low of day. A reset trade at Friday’s gap would be in the cards as well.

Result: After scalping SPY on the first flicker, I was watching and executed on QQQ 434 calls as we approached the previous close. While it didn’t properly test it where I entered, I wanted to average into it. It worked well following entry. I take profit when in hand. Not looking for major moves. Again, look at how the entry and exit of this trade is a small peak and valley within a larger set of peaks and valleys. This is how I capitalize daily.

August 5

Trades:

Trades Taken: 1

SPY

Plan: Quite the market sell off. In fact, the largest sell off premarket that I’ve seen in my short career. While I will make trade plans today, very unlikely I trade.

505 gap is interesting for a long, 518.30 range for a short. Amazing the gap between by levels is over 13 points (usually 4-5).

Result: A nice move into short level for a morning trigger, but I had already taken a trade on QQQ.

Lesson: Look how small the trade box looks in the premarket plan. The size of the box hasn’t changed, it’s the RANGE of the market. Increased risk today.

I trade for consistency, I like when the market is moving “normal”. Go through my plans and tell me I don’t have a pulse on what normal is. Today is NOT a normal day. Major volatility and fear in the market. Wide moves to be expected next few days. A non normal day calls for no trading or VERY small size trades.

QQQ

Plan: 420.78 and pm lows area for a long, 432.56 for a short.

Result: As expected, big moves. We got a quick one minute dip on the markets, nowhere of MAIN support I had, so no longs. With a push straight into 432.56, I executed the QQQ 433 Put and paid out on the first push. Beautiful FIRST REACTION trade. I don’t care what happens on this volatile day, my job is done, and first reaction was a pay day as usual.

Lesson: This reaction was a quick one, with one red candle coming straight into the 9 ema on intraday (a target I use to pay myself). Check the entries chart. EXPENSIVE options today (costing in the 4.00 and 5.00 instead of normal 1.00 or 2.00). Another example of increased risk (contracts costing more). I was all in and all out on this one, nice move as expected.