August 16

Stock charts provided by Tradingview.com

Entries charts provided by IBKR.com

Trades Taken: 2

SPY

Plan: Did not have time to write up plan this morning before open, but the levels for SPY short (still timestamped) were previous close for a short, and low of day for a long.

Result: I started with SPY 553 Puts as we cleared initial morning highs and started grinding up. Check out the entries chart on this one, a great lesson. I had three rounds of buying, all followed by a round of selling. Playing the games of peaks and valleys around support and resistance levels is all this is. Confidence in how to execute takes time. I was all out after first proper test of level and reaction. Ended up working even more later, but I go after first reactions.

Second trade of the day came with SPY 552 calls. I used smaller size on this one, as you can tell this isn’t a normal trade for me. I have been aiming to take a trade like this for a lesson I am looking to teach. More on this one to come soon, but it’s all about understanding NATURAL price movement, even when action is going against you.

Two nice trades, one to plan, one to work on skills and teaching opportunity. Great way to go in to the weekend.

QQQ

Plan: Plan on QQQ was short in to previous close, long into low of day, 468 range.

Result: QQQ short worked very well to plan, but I was focused on and traded SPY.

August 15

Trades Taken: 2

SPY

Plan: Premarket news/numbers continue to have large moves this week as shown by this morning’s large gap up, sparked at 8:30. Today will likely be focused on seeing how we open and what kind of distance we have on the first move. As of 9:00 am, SPY has almost 3 points to go for a proper short, and 5 points for a proper long. Extremely wide thanks to this gap up. There will still be opportunities surrounding the levels placed by utilizing the different types of trades.

If spy breaks premarket highs and moves towards 552.50, this is interesting. I will play smaller size on longs as we approach levels, but the previous high of day into previous close is interesting, but far and unlikely this morning.

Result: The markets popped for the first few minutes, then dipping. SPY was first to test so I executed with SPY 549 calls. Nice trade. Notice, I sold instead of buying, fixed it right away with no major impact. Can you spot this small mistake in the entries chart? Regardless, a nice trade on first reaction.

QQQ

Plan: 471.76 range into the 50 ma for a short on QQQ. For a long, I like distance into yesterdays high of day.

Result: First big move came from QQQ into 471.76 resistance level. With nice speed and distance, I averaged in with QQQ 473 Puts. An awesome first reaction and nice pay out!

Lesson: Notice I went further out on the strike instead of using 472 puts? That is because I needed to give the risk to the 50 ma on the daily. While we didn’t push past the level, one needs to be prepared.

August 14

Trades Taken: 2

SPY

Plan: CPI numbers out this morning at 8:30, as mentioned yesterday, numbers like this always shakes things up. For a long on SPY I like a test of end of day VWAP and 20 ma area on daily chart. SPY could get very well bounce at previous close, but as of 9:15 the way things are shaping up, I need more distance. For a short, I like 546 into 547 area. A full point between levels here, certainly wide.

REGARDLESS of what trade is taken today (if any), it will be smaller size and focused on execution and small reactions. A day (heck a week) of volatility is a great time to focus on fundamentals within the chaos. Not every day is a day to step on the gas pedal, today is one to focus on price action and learn.

Result: After an initial flash up, both markets dipped straight into the previous close. I initiated with SPY 541 calls for a clean first reaction, right back into the 9 ema on intraday. Clipped the trade in pieces with an almost perfect last exit as we tapped the 50 ema intraday. The action ended up failing after the trade. How am I so consistent even on trades that end up going the other way? The answer is quick first reactions and not being greedy! Spot the pattern of this throughout my trade plans and result.

QQQ

Plan: For QQQ, I like a test of 20 ma and end of day VWAP for a long, similar to SPY. The distance from previous close to this 20 ma is 2 points, but in this market, that is not terrible. Small size can allow for give on this. For a short, I like both 466 and 468, a tough one with that range. I do like the short better on SPY, the long better on QQQ.

Result: The QQQ 460 calls trade opportunity I’m glad I spotted and took for a great lesson.

Lesson: See the chart linked below for a side by side view of entries chart and trade plan. This trade highlights the distance between two levels. After working on the first level, then failing it, I aim to start halfway between the two levels, wanting a move back up to test the underside of the level. This happens quick, as this shows just one green candle and we test it. Call it scalping, but yes there are quick CONSISTENT reactions like this. One can also play the short side, using a head bump trade. See types of trades to learn more.

August 13

Trades Taken: 2

SPY

Plan: Numbers premarket both this morning and tomorrow morning (PPI and CPI). You don’t need to be economist to learn that these numbers give off a bit of a stock market earthquake. Tomorrow’s should be even larger.

For SPY, we have two unfilled gaps on the horizon for short plays. The higher one comes right around the overall downtrend. I will be stalking the first test of downtrend, whether that is today or later this week. For a long, potential remounts of resistance levels, but a proper long would previous close and premarket low area.

Result: Out of the gate I went with SPY 539 puts as we approached entry are with speed and distance. Nice pay out on first wash into 9 ema intraday, beautiful scalp here. Two more trades on QQQ listed below.

QQQ

Plan: Similar to SPY, for QQQ I am watching the overall downtrend marked on the daily chart. This does line up quite nicely with the 459.66 gap fill and 20 ma. For a long, previous close similar to SPY, with moving averages acting as protection.

Looking for DISTANCE today, and as of 9:00 am est, I like QQQ short the best at trend and 459.66 gap.

Result: For my second trade, I took QQQ 456 calls on the first pullback into level. A nice play that I stalked while gauging the price action. A nice first reaction on the level, ended up trapping and squeezing all day, this was a great entry.

Lesson: SPY 539 calls was the true “to plan” trade as it incorporated speed, distance, FIRST DIRECTION, first test, and proper time of day. While I really wanted the QQQ trend test, it happened outside my trade time, so I let it go. Discipline is key, can you avoid the fomo and greed?

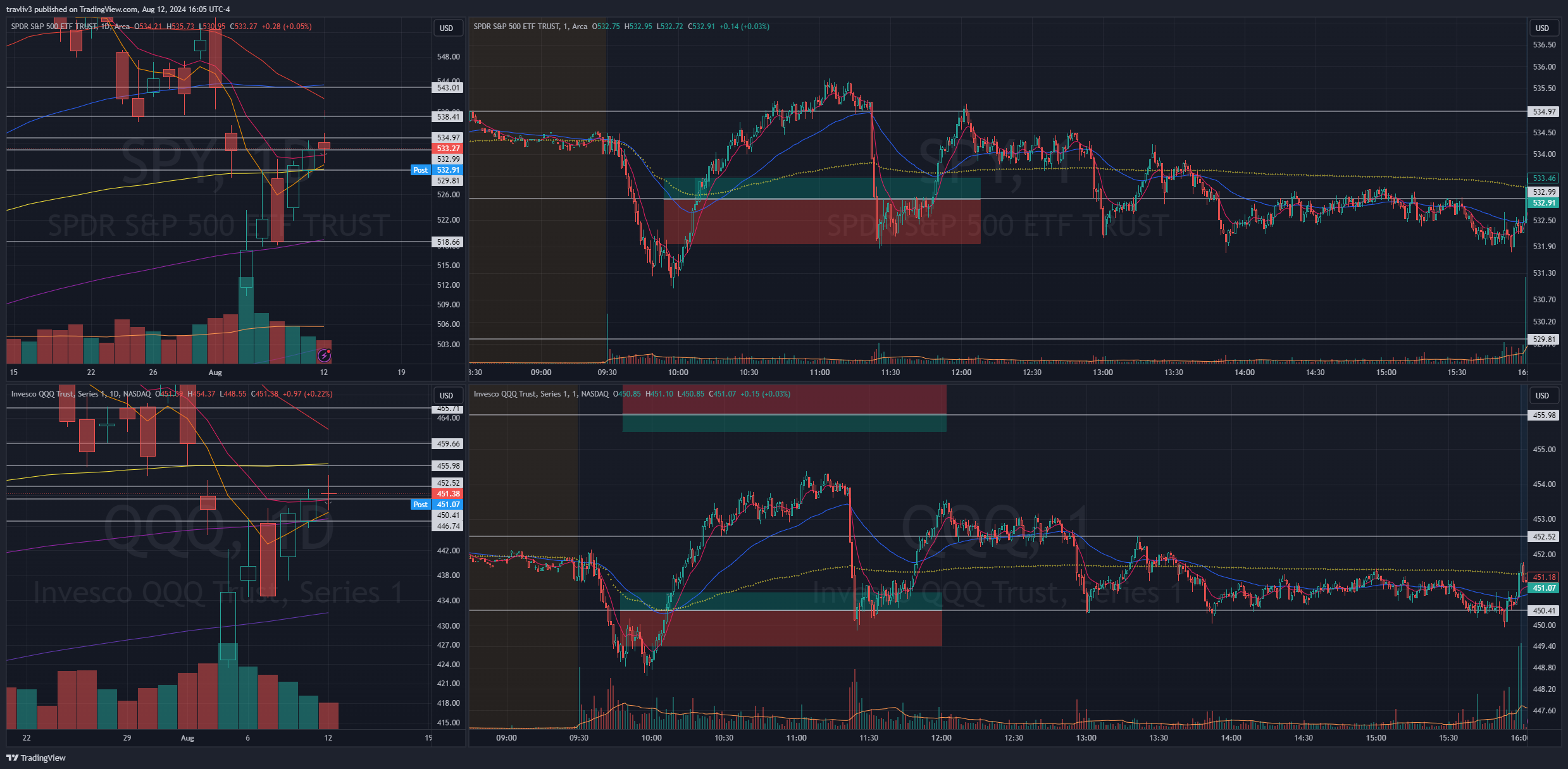

August 12

Trades Taken: 2

SPY

Plan: Markets are both gapping up slightly. Strategy dictates a long into previous close with protection of the 9 ema on the daily chart for SPY. For a short, I like 538.41 area and another gap fill at 543, but premarket highs will present the first short opportunity. I much prefer the long as it is closer, the more sound resistance levels are farther away.

Result: Both markets opened a bit sideways, I started with calls knowing the protection we had. I took SPY 533 calls and the action sliced right through the previous close. Sticking to my training, I continue to add (into the 9 ema on the daily) and paid out as we started to retrace. Ended up slightly red on this trade but see below as to why I’m happy with it. I also took SPY 535 puts keeping a nice tight range and target. This nice tight trade got me green on the day after being down big initially on my first trade.

Lesson: Learned how to lose is crucial in trading. Everyone wants to show their winners, but not their losers. This trade in particular had extended risk. I knew this, stuck with the trade, and added to strategy. I did not get my average perfectly where I wanted it, but not bad. Excellent consistency on paying out as we come back close to my average. As you can tell, a nice second group of selling back in to the original level. Turning big red trades into small ones is how a trader grows. My favorite type of trade is actually taking a big loss and turning it into a papercut, just like today! See the progression of the trade below.

QQQ

Plan: Similar to SPY, for QQQ I like a dip into previous close and 9 ema for a long. I like the short here better than spy, with the 456 area being of interest, but QQQ will also have to get through premarket high test first (marked). Another gap further above for a later trade potential at gap of 459.66.

Result: