November 8

Stock charts provided by Tradingview.com

Entries charts provided by IBKR.com

Trades:

Trades Taken: 1

Trade Plan

Plan: Not a huge reaction to FOMC yesterday, still overall a big move in the markets with the election this week. QQQ has the cleaner channel, pm highs for the short and a pivot area from yesterday for a long at 510.36. I do prefer the 505.58 but that will likely not test today, and certainly not in the morning session. For SPY, pm highs for the short, yesterday’s lows for the first round of daily support. Gap at 591 is also quite interesting.

Result: Both markets pushed out of the gate, no surprise. QQQ had more distance into level, something I noted during premarket, so I went with QQQ 515 puts for a fantastic reaction. Great disciplined trade to end the week.

November 7

Stock charts provided by Tradingview.com

Entries charts provided by IBKR.com

Trades:

Trades Taken: 1

Trade Plan

Plan: A very clean morning yesterday. While the market did squeeze, morning levels were well respected as usual. A gap up this morning with FED catalyst at 2:00 today. Nothing new here, looking for first reactions out of the gate into a predetermined level of support or resistance.

SPY, a dip into previous close with proper sped and distance would get me long. Only premarket highs to work with for a short as of 8:55 am. Multiple levels marked for longs. Very far for some. I like to mark what ifs when we get volatility like this (and especially with FED coming at 2:00. The only levels to mark right now are below/longs). QQQ, I like previous close for a long. Also no real short to work with other than pm highs and intraday opportunities.

Result: Not much to work with in terms of levels. SPY did remount pm highs quite cleanly, but that’s not the long I was looking for. I took QQQ 511 puts on the idea of extension as we did squeeze hard relative to SPY out of the gate. A nice trade, will see if I get my proper triggers tomorrow.

November 6

Stock charts provided by Tradingview.com

Entries charts provided by IBKR.com

Trades Taken: 2

Trade Plan

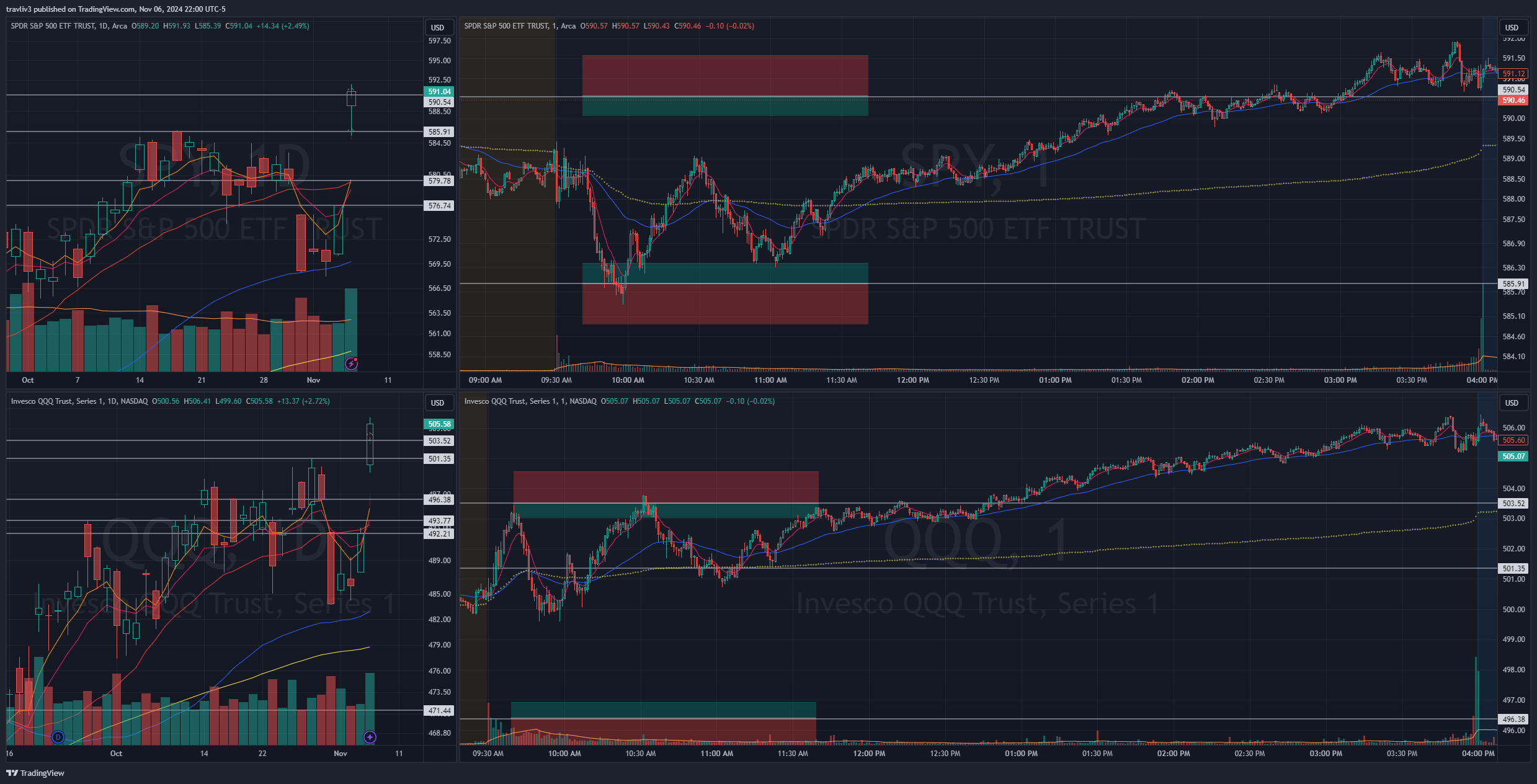

Plan: Nice gap up and positive reaction to election results. Too volatile too apply major size to anything, but I do favor the long on a dip.

Result: A pop at the open got me short with QQQ 504 puts. A fantastic reaction on this trade. Next up came averaging into SPY 585 calls as we broke initial morning lows and screamed towards first level of support. A great reaction here nailing the first round, added, and paid out again. Fantastic trade. Some quick, hard moves today that really produced.

November 5

Stock charts provided by Tradingview.com

Entries charts provided by IBKR.com

Trades Taken: 2

Trade Plan

Plan: An undecided premarket heading into 9:00. For shorts, I like moving averages on both markets. The longs could be previous close if we have enough distance. Multiple areas for a long opportunity today if the previous close breaks.

Result: A squeeze out of the gate gets me short with QQQ 490 puts. A few rounds of buys right into yesterday’s highs and moving averages gets me a fantastic average for a nice payout almost instantly. I don’t stick around for follow through, I get the first move and move on. CONSISTENCY.

Second trade came on SPY 575 puts as we continued to squeeze into the 9 ema on the daily chart. Much smaller size on this one, was already green on the day and no need to turn the day red. I ensure this by using proper size. I did want to work on patience with this one, and it worked out well. Patience and discipline for yet another first reaction base hit.

November 4

Stock charts provided by Tradingview.com

Entries charts provided by IBKR.com

Trades:

Trades Taken: 1

Trade Plan

Plan: As of 9:00, both markets smack in the middle of the trading channel, great sign. I will be trading very small size this week, focus on execution and discipline. Election is tomorrow, FOMC on Wednesday, a lot of catalysts. Looking for a morning trigger and that’s it.

SPY, I like high of day and moving averages short, 50 ma and 568 gap for the long. QQQ, I like 483.85 gap and 482 gap for the long. A bit wide, but it’s there and lines up with SPY. High of day and moving averages above for the short. Straight forward channel this morning, just need the market to pop or drop.

Result: A dip out of the gate means I go long to plan. I went with SPY 568 calls for a fantastic first reaction trade back into the 9 ema intraday. Great trade to start the week.