Stock charts provided by Tradingview.com

Entries charts provided by IBKR.com

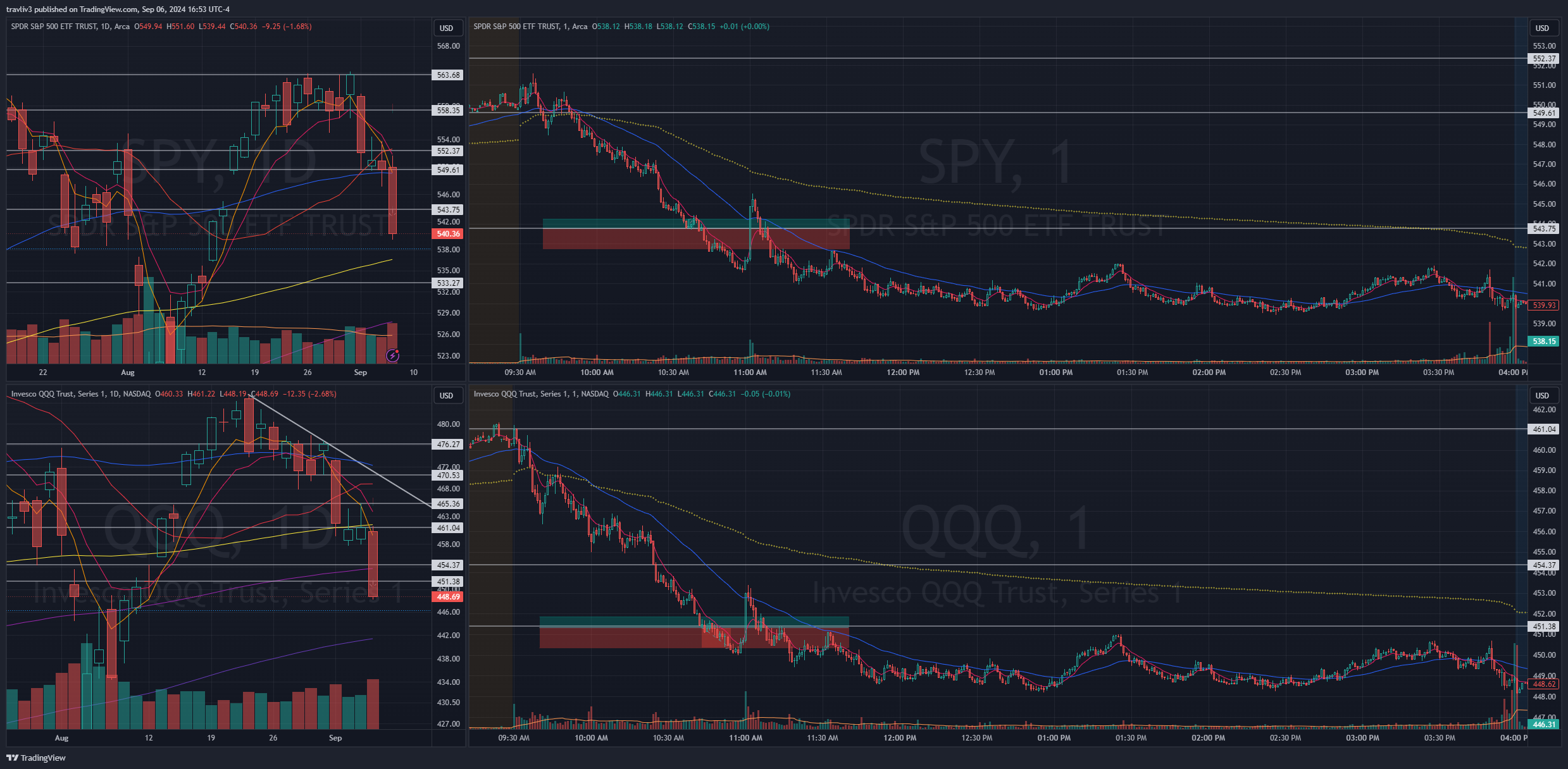

September 6

Trades:

Trades Taken: 0

SPY

Plan: Gap down during premarket, then 8:30 numbers send price action to test underside of previous close, a nice trade opportunity if the market had been open. Being a perfect 9 for 9 on the week, I will be sitting today out. A short week already, but the opportunities really produced this week. I will make plans regardless. Friday’s are the most emotional day of the week, action can tend to run further than anticipated. Seeing that my trade boxes are wide today, it’s just another factor telling me not to trade today. It’s not about money, it’s about understanding yourself and the market. Part of maturing as a trader is knowing when to sit on the sidelines and study.

For SPY, I’d love to see a channel between moving averages and previous close. A test of previous close for a long (IF we open ABOVE it) is interesting being Friday and a bit of a consolidation day yesterday. Proper long is on a sell off into the gap fill around 544. I don’t love the moving averages for a short, but it’s there. Much prefer the short at 558 range level.

Result: Quite the sell off today. Markets tested underside of moving averages and sold off the rest of the day. As I stated in the plan, Friday’s are emotional. Today is the perfect example.

QQQ

Plan: For a long on QQQ, I like a sell off into gap fill down at 451. Two decent short opportunities marked at 465.70 at 470 areas.

Result:

Stock charts provided by Tradingview.com

Entries charts provided by IBKR.com

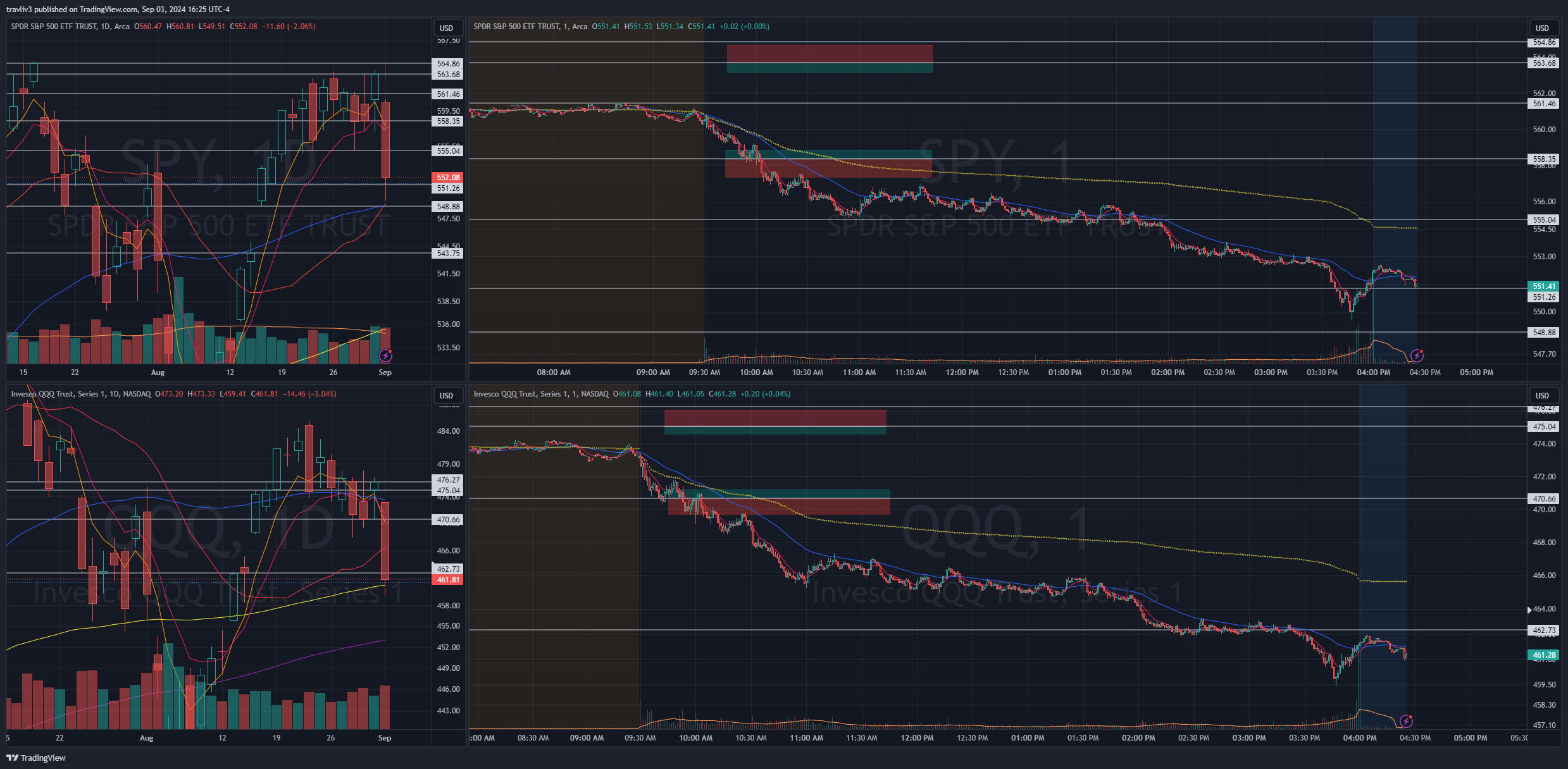

September 5

Trades Taken: 3

SPY

Plan: Pretty clean action yesterday. Slight gap down this morning with markets trying to reclaim previous close. I do like remounts of previous close IF/WHEN we test them, but the proper longs for today would be the lower gap fills, for SPY that would be at 543.75. That would call for a bit of a sell off. For a short, I like a straight push into moving averages. This worked later in the morning yesterday, so this would be a second test of MA’s. With enough speed and distance, I would be ok with that risk.

The trade boxes are far today on SPY, that’s just how it is some days. There are levels close (marked) and if I do take these, they are smaller size than the proper trade levels I want.

Result: Second trade of the day came on SPY 555 puts. I’ve mentioned a few times this week about time of day. This was a great way to teach (by example) how I can take advantage AFTER the volatility hits. Volatility spike at 10:00 (like I’ve mentioned earlier this week). This drives the action close to my short trigger on SPY, I start in small at 10:02, and again pay out on a reaction down to the 9 ema on intraday. Not looking for a large move (even though it did produce). How are you at avoiding greed?

QQQ

Plan: For a short on QQQ, I like a straight push into moving averages, similar to SPY. Short trade box is set at previous close as we haven’t gotten past that yet. The proper long is on a failure into the gap fill of 451.38. Both markets have some room to run to the downside IF/WHEN we break yesterday’s low of day.

Result: First trade came on QQQ 461 puts. Most will look at what the price action did at the designated short level and think it didn’t work. Well, see for yourself how I bought INTO that level and pay out into my first target (9 ema on intraday) for a beautiful first reaction. Distance from high of 9:33 candle to low of 9:34 candle is 92 cents. Anyone who has studied my trade box knows I aim for 50 cents. Yes, these first reactions can happen in a matter of minutes, hence why I use the 1 minute chart for executions. I just needed one red candle on the charts to profit on the move.

Third trade on the day came late morning on QQQ 457 calls (also see QQQ 457 big picture). A quite rare late morning trade for me, but let’s go over the reasoning. Here are the factors I considered: speed, distance, original trade level idea, first test, premarket lows, yesterday’s lows, 7 point sell off from short level. I stalked this trade after an alert I had set went off. Averaged right into the test of level, and paying out on the first push/reaction into intraday 9 ema. Another trade, to plan, executed with the right patience, mindset, and discipline.

Stock charts provided by Tradingview.com

Entries charts provided by IBKR.com

September 4

Trades Taken: 3

SPY

Plan: Wide range in the market yesterday. First reactions held up well. Another gap down this morning. SPY held moving averages and yesterday’s low nicely through most of premarket. Previous close would be the first level of resistance I’m looking at. If it continues up, moving averages of 5 and 9 on the daily chart lines up nicely with end of day VWAP and previous range that we held for a bit yesterday (where I took one of my long trades).

For a long, the 20 and 50 ma/premarket lows/ yesterday’s lows is all in one area. Can’t ignore that, but I need distance. Taking this trade would be smaller size simply due to how close we are, and the feelings of what the chart says should be another wide day. Further down we have a five point dip into a gap fill. Potential for another wide range day.

Result: Three trades on SPY, all before 10:00. Volatility hit at 10:00, I just gave a lesson yesterday on importance of time of day at what frequently hits at 10:00.

First trade was long, out of the gate. We opened very close to level, took small size on SPY 549 calls. Paid out on the first quick push, not enough size to hold anything here.

Second trade on FIRST push into short area, not much give into first target with the SPY 552 puts, but I paid out for a small gain. I didn’t like the squeeze potential, so I waited for the pullback long opportunity, leading me to trade three.

Third trade small execution on pullback with SPY 550 calls and paid out back into highs.

Lesson: I just mentioned (AGAIN) yesterday the importance of time of day. Markets are manipulated with news and numbers, understand when these are scheduled. Often times it is 10:00. See how the charts react massively at 10:00. Sure, it worked in favor of the trade today, but that’s not always the case. Learn to trade professionally, or you can go the gambling route….

QQQ

Plan: Plan is cleaner on SPY, not as clean cut for QQQ. For a long on QQQ, 454 then gap fill, both marked. For a short, previous close is first level of resistance, then a test of moving averages just above.

Result: I liked the plans better on SPY, so that is what I focused on.

Stock charts provided by Tradingview.com

Entries charts provided by IBKR.com

September 3

Trades Taken: 3

SPY

Plan: A gap down this premarket, then so far a steady range. For a short, I like previous close risking into all time high’s. Another sneaky level at 561.50 area. I say this because if you take away the 10 minute squeeze to end Friday, this area would have been the close, and the resistance is obvious on intraday chart.

I don’t like the long nearly as much, because if we stay where we are are, we are likely right in-between moving averages on daily chart. 558.35 on the long should give enough distance if we get there, but range low at 555 is what I would prefer.

Result: Second trade came on SPY 558 calls. I was already about done with the QQQ trade as it triggered first. I started a tad early on SPY, but correcting the average as we hit level, and then out nicely on first reaction. Done on both trades before they hit risk area, both did fail into risk, but I was already done by not being greedy and hitting my targets professionally.

Third trade of the day came on extension. Both markets selling off, SPY came in to range lows as QQQ was coming in to lip of gap. I decided on taking SPY 555 calls, on the level I had marked for extremes today. Nailed lows, hitting a nice add right before the big push, pulling profits right into first target. Nice trade!

Lesson: 1. I try to avoid biases. You can see in my plan that I preferred the shorts, actually stated I wasn’t a fan of the longs. But, the market dictates the trades I take. I take the trades that trigger in accordance with my Checklist prior to a trade.

2. Time of day is crucial. It is part of my Checklist prior to a trade. News and numbers are often released at 10:00 am. Today’s volatility really triggered then, I saw it in real time and can attest to that. This is a crucial reason why I aim to be out of a trade by 10:00. While I may take trades later than 10:00 (rare), it is important I pay attention to being in a trade at that time.

QQQ

Plan: If we keep falling in premarket, I like the underside of moving averages for a short risking into previous close. For a long, Friday’s lows/Thursday close is enticing. A long into the 20 MA and 462.73 gap fill is very interesting, but that would be a wide risk (almost 3 points, my normal risk is 1 point). I would normally split that into two trades. Also very far away, so many factors to consider here (time of day), might be a trade to watch for tomorrow IF/WHEN we get to that level.

Result: First trade came on QQQ 470 calls. After failing moving overages on the first minute (to quick of a test for my liking), I waited for some down pressure and then started on calls, nice averaging and pay out on first reaction at designated trade level.