July 5

Stock charts provided by Tradingview.com

Entries charts provided by IBKR.com

Trades:

Trades Taken: 1

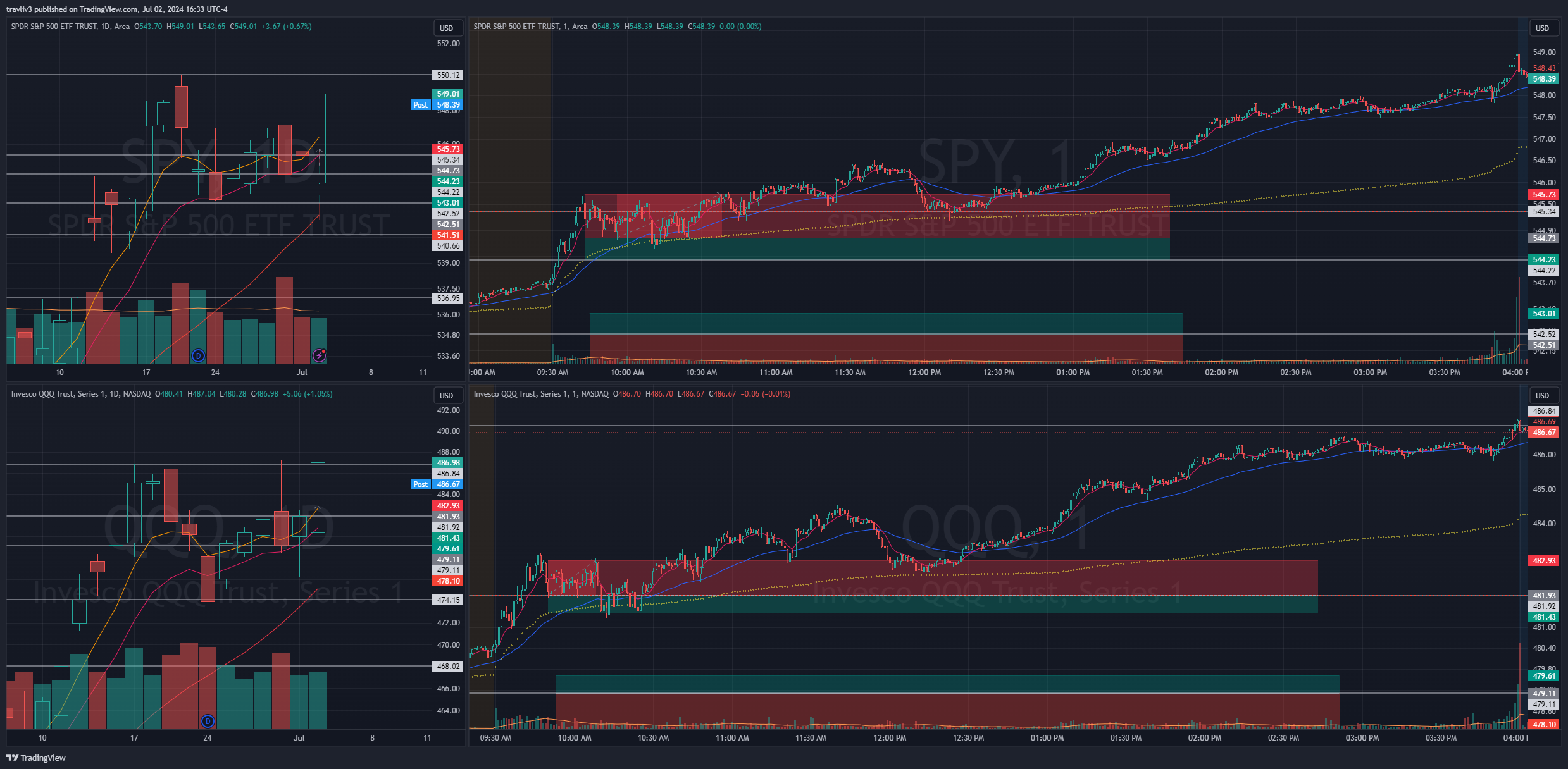

SPY

Plan: Friday, small size, will not trade if we open consolidated. Friday’s in general are the most emotional day of the week in the markets, especially following a holiday. In my opinion, Friday’s are a great opportunity for discipline. Small size, triggers only, first push. Let’s see if we get it.

End of day VWAP (yellow dotted line on intraday) for the long, not really interested in the short, but PM highs would be the only option at this point.

Result: Took spy puts on the first large move, nice averaging, sizing bigger with each purchase allowed for a beautiful average and quick payout. BEAUTIFUL execution, very happy, done with my day 16 minutes after opening bell, RIGHT TO PLAN.

QQQ

Plan: End of day vwap for the long, reset at previous range of 487 if we get it. Short, pm highs is only option, not very interested.

Result: If you see where we opened, we opened in the green entry area of the short, so no distance as dictated by Checklist Prior to a Trade. No distance, no trade. Focused on spy as it had more distance.

July 3

QQQ

Trades:

Trades Taken: 1

SPY

Plan: market closing early today, low volume, closed tomorrow. Looking for a long trigger by 10 or I’m not trading it today. I’ll take a stab long at the end of day VWAP, it’s also a nice pivot point intraday yesterday. short at ATH, much prefer the long today,

Result: focused on QQQ short this morning. SPY short worked just fine a bit later in the morning, but as you can see 10:00 numbers can affect that. I aim to be done by 10:00. I was done again today with QQQ very early in the morning as you will see described below.

Both markets had very clean remount opportunities of the previous close. I was already done with my day by the time this occurred. Learn more about remounts on the Types of Trades page.

Plan: looking for dip into end of day vwap, i like the long better on spy. risk isn’t too bad from previous close to premarket highs for a short, but again I prefer the long today. won’t bother with the qqq short if there is no distance at the open.

Result: QQQ pushed up out of the gate, took it short into entry area of previous close, added on push up, paid out nicely on first push. I’m done with my day 5 minutes into market open, right to plan….

Lesson: The trade may continue to work for the day, or it may turn around. That’s not what I’m after, I’m not chasing home runs, I got my base hit for the day IN 5 MINUTES. I executed to plan despite fighting fear while in the trade. Major win all around.

July 2

Trades Taken: 2

SPY

Plan: I really like the long at 20 ma and range low 540 area. Gap fill 537 long whenever it does trigger will be a good one. Will try at low of day first if there is enough distance. a straight push up into moving averages gets me short with protection of the previous close just outside of risk. first directional pick is important

Result: Short triggers out of the gate. Started with spy into moving averages, had to add in to the previous close. Took this trade to the uncomfortable spot (top of risk), held my cool, added, got out on retracement. Very pleased with how I traded this. I hit this later into previous high of day and made it a green trade overall

QQQ

Plan: previous close for the short. moving averages for a long are tough, only if we have distance. The long I’d really like is the 20 ma and gap fill area at 474. This likely won’t trigger during morning session.

Result: Short trigger into previous close out on first wash, beauty to plan.

Lesson: Don’t get caught up in seeing the price move past the levels. Check the provided entries chart and see how even on a squeeze day, a professional can be green with puts! Remember, FIRST test of the level is what is of focus!!!!!!!!!!

July 1

Trades Taken: 2

SPY

Plan: Previous close and the 9 for a long. 547 area for the short.

Result: took first candle dip, out the next minute for a nice move. previous close test worked very well on first test, right to plan.

QQQ

Plan: I like a dip into the premarket low, previous close, low of day, 9 ema. Loads of protection if we dip first thing in the morning. Short, I’ll take a stab at end of day vwap, friday’s open area. Nice intraday pivot point there too.

Result: Test of previous close for the long worked well out of the gate. The short trigger worked well later in the day