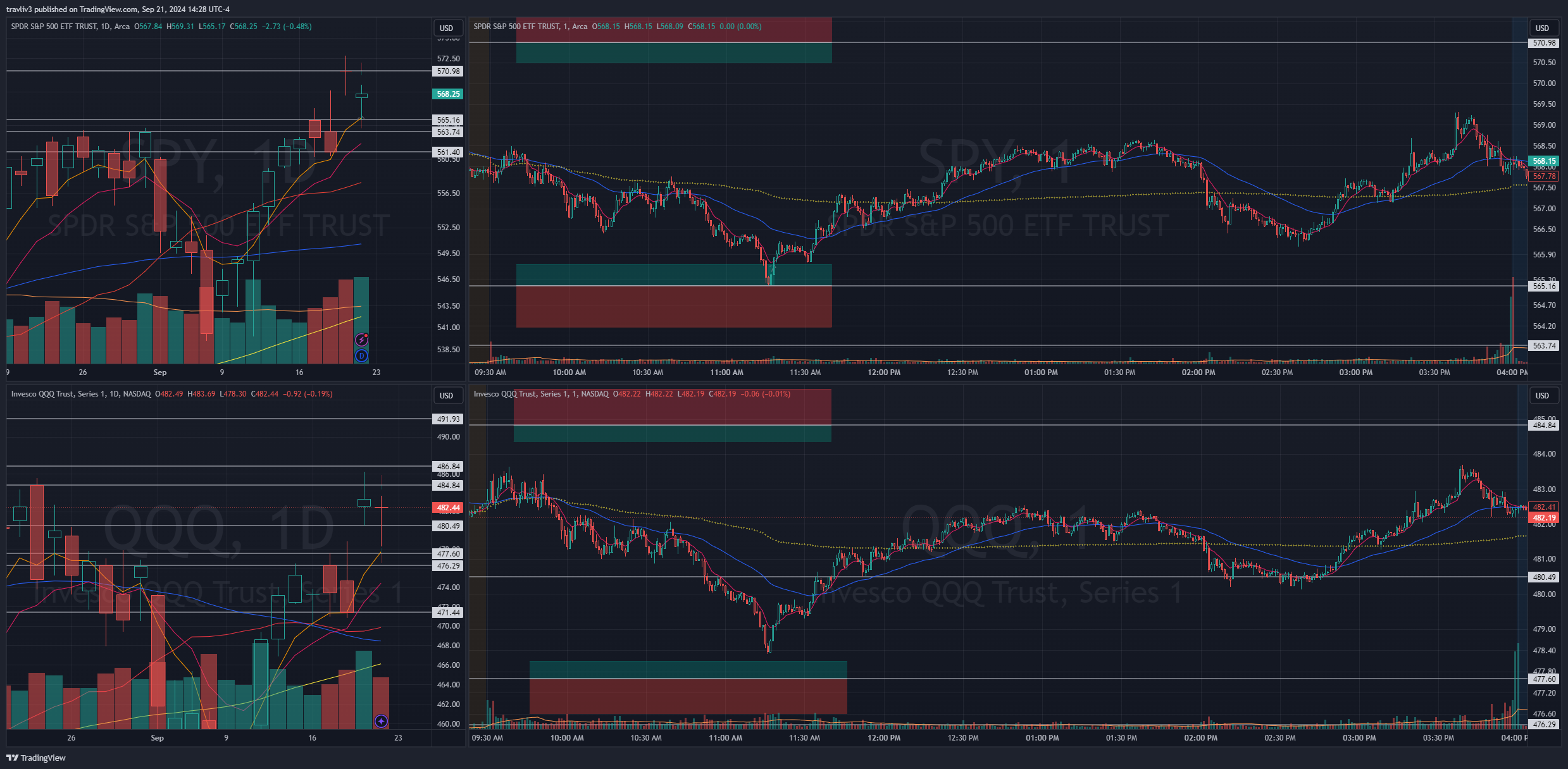

September 20

Stock charts provided by Tradingview.com

Entries charts provided by IBKR.com

Trades Taken: 3

SPY

Plan: Interesting doji candle yesterday as SPY was above all time highs (Doji refers to when the opening price and closing price of a candle is very close to each other).

For SPY long, I like a dip into previous all time high 565 area. This area is also protected by moving averages and daily levels. If it wasn’t Friday, I would use bigger size on a protection trade like this. But if you’ve been paying attention, Friday’s should be cautionary. For a short I like a test of the previous close.

Result: No true triggers during my normal morning session. I did spot a few opportunities that I took advantage of. With them not being a true trigger, they were the first round of buys to average into the trade. Both worked well and gave nice first reactions into normal first targets. My third trade gave a proper trigger, and I worked it well.

Second trade came on SPY 565 calls as we started trending lower, I look for break of lows with speed and like to start my averaging into level. Just like on QQQ, this gave reaction right away.

Third trade came on the same calls, but a proper test late morning. SPY 565 calls full screen shows the patience, discipline, and trust of my levels. An awesome way to end the week on this trade.

QQQ

Plan: Low of day for a first test long, then moving averages and previous range around 477.60 for the reset trade. For a short, I like the same 485 area that I took yesterday.

Result: First trade came on QQQ 480 calls as we breached morning lows and failed hard towards yesterday’s low of day. Started my averaging with first round of buys, and then all out as we came right back into 9 ema intraday. Nice 10% trade here. Notice how the price actions comes right back down to lows. This is purely a game of peaks and valleys. Understanding how the markets move, one can take advantage of the natural peaks and valleys.

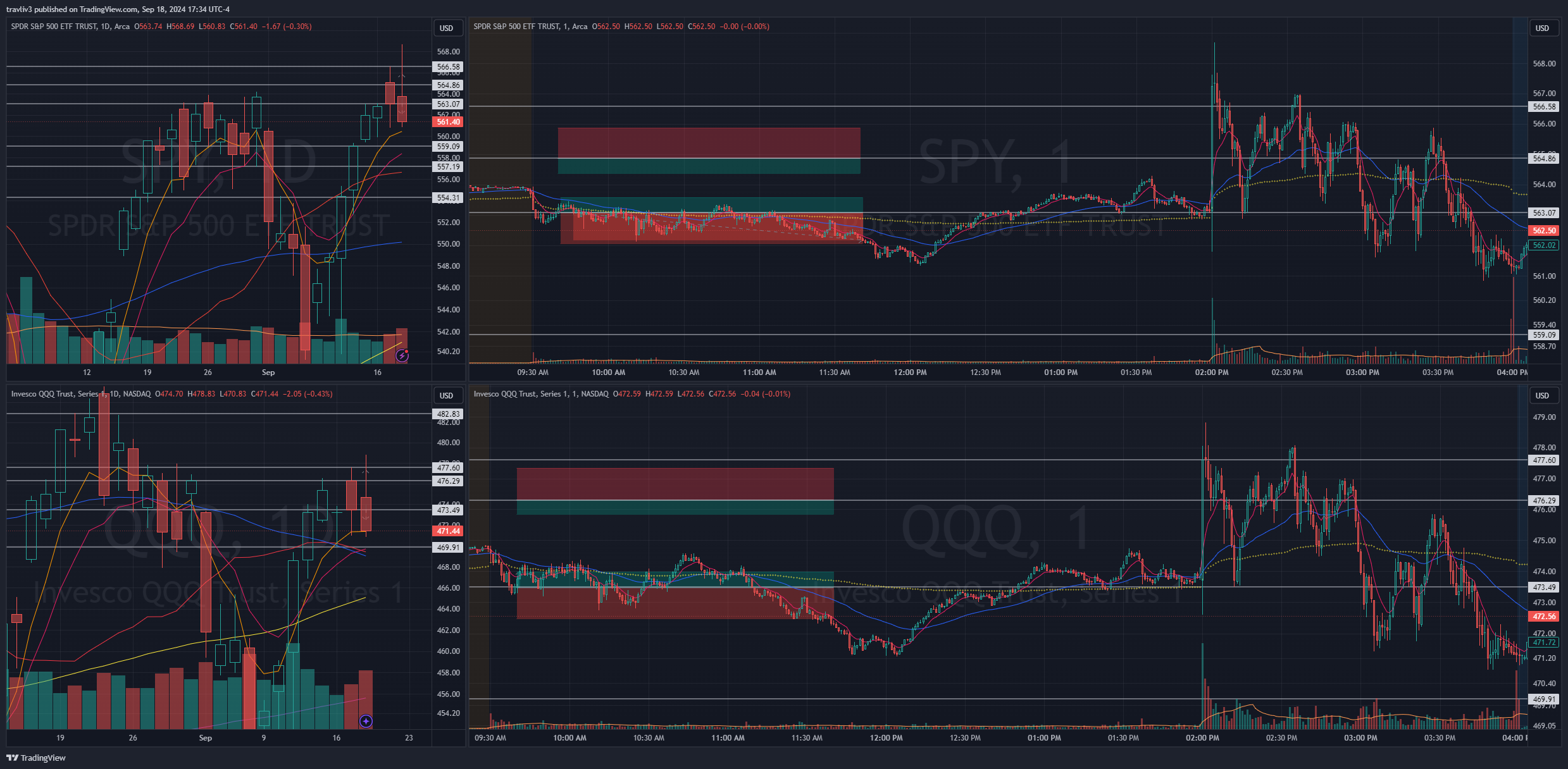

September 19

Stock charts provided by Tradingview.com

Entries charts provided by IBKR.com

Trades:

Trades Taken: 1

SPY

Plan: Large gap up, a continuation from yesterday’s fed decision on interest rates. I mentioned yesterday how catalysts like these are earthquakes. The reaction regarding volatility can last a few days, we are seeing that this premarket. Ranges are wide today, likely won’t trade today, will wait for things to settle down.

Remember, I trade pure technical levels. Levels don’t get the normal respect when catalysts are involved. Pay attention to these trends. I try to be very selective around catalysts, and if I don’t end up trading a certain day because of that, I’m ok with it. That is part of maturing in trading, you don’t need to be involved every day.

For SPY, a test of the previous all time high is interesting for a long. I don’t trust yesterday’s highs as it was the reaction to fed speak. No true short other than premarket highs, which I’m not interested in.

Result: No trigger on SPY.

QQQ

Plan: For QQQ, there are three levels for shorts marked. The first one may trigger today, but the others will likely be tested in the near future, IF/WHEN we continue up, and will be of interest when the test. For a long, I like the 476 area.

Result: No trigger on QQQ in my normal trading window (prior to 10:00 am). I did take QQQ 486 puts on second test in later morning session, I missed the first test as I was away from my computer (taking my son to the bus stop). A very nice trade, producing almost 20% in 2 minutes as I peeled my profits on first reaction on this all in, all out type of scalp trade at level. Even on volatile days, the proper volume levels produce nice first reaction results. Consistent base hits is how I approach the market. Would you have looked for a home run today!?

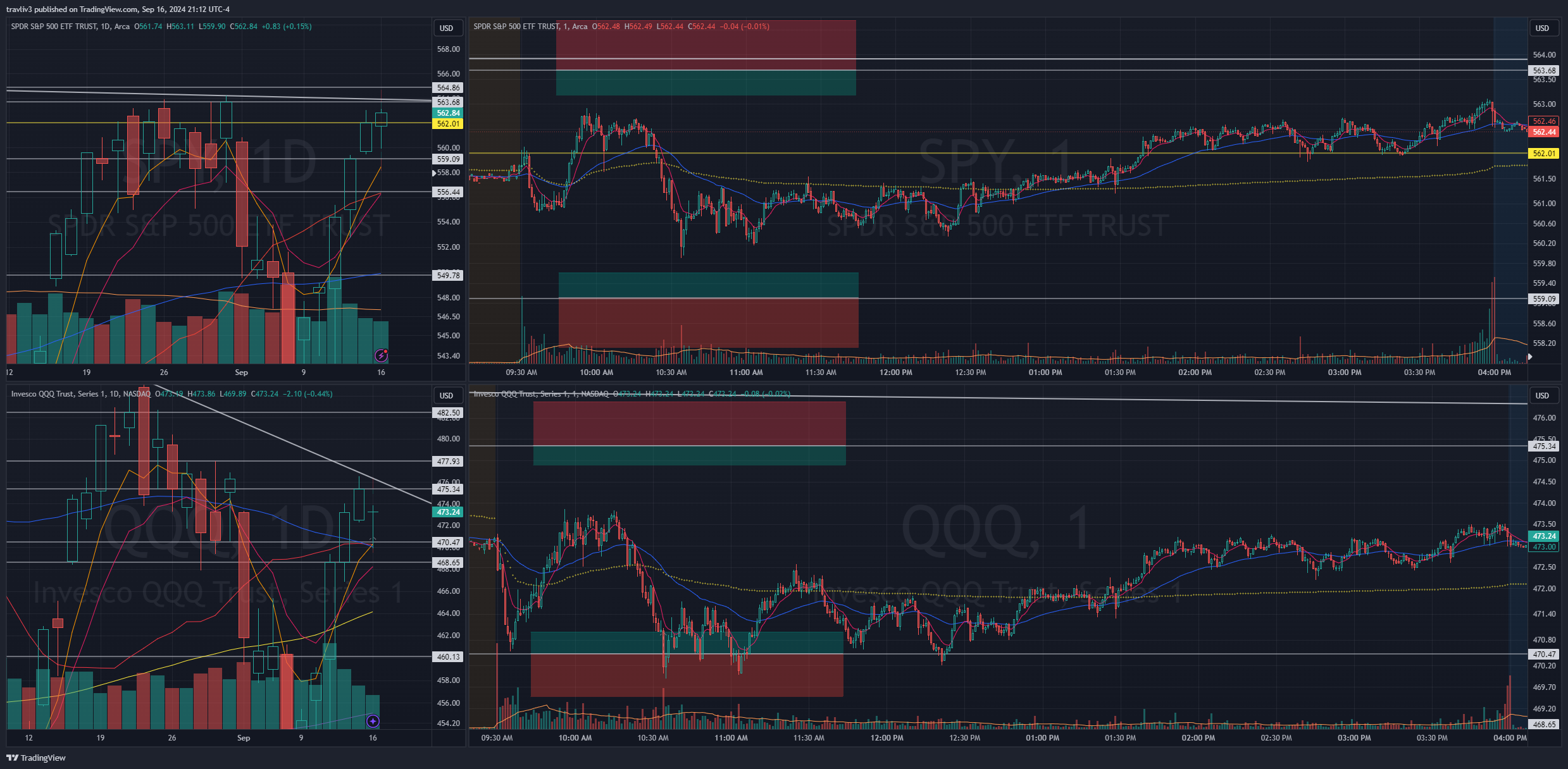

September 18

Stock charts provided by Tradingview.com

Entries charts provided by IBKR.com

Trades:

Trades Taken: 1

SPY

Plan: Inner channel on SPY this morning is quite tight. For a first long, previous close is certainly there for a support test. There are two resets for a long trade, one at a gap fill, the next would be moving averages. For a short, yesterday’s open/previous ATH is really interesting, but it’s close.

Result: First minute dipped hard into previous close, I waited and ended up taking QQQ long. Knowing how tight SPY range was, I held off and gave the market a few minutes. I’d like to think that if I did take SPY long, that I would have worked it well considering it stayed within risk and pushed to 50 ema on intraday.

QQQ

Plan: For QQQ, previous close for a long, with a rest trade down at moving averages. For a short, yesterday’s open risking into highs.

Result: Took QQQ 473 calls as we approached previous close. Not the cleanest average, but I did stay consistent with my target and the trade worked quite nicely for another first test reaction in the books.

I caught myself wanting to chase a few trades this morning after my first trade. I feel this comes from not being content with my first trade. It worked great, but as I work on using more size, being content with the average and trade management is paramount, no matter the outcomes. Growth comes from being uncomfortable and learning from uncomfortable situations.

Fed news later in the day, really shows what type of market earthquake that can cause. This is why I stay away from news/catalysts.

September 17

Stock charts provided by Tradingview.com

Entries charts provided by IBKR.com

Trades Taken: 4

SPY

Plan: Gap up this morning. Two long levels on SPY, ATH test FROM ABOVE since we gapped above it. We may not have distance but this level is important today. Next long lower would be the previous close. No true short as we are in new territory.

Result: Out of the gate SPY dipped on first minute, holding level, then pushed to premarket highs. I took a nice scalp for my first trade on SPY 566 puts. paying out nice a quickly into opening price.

QQQ

Plan: Two gap fills to work with on the long side for QQQ, both marked. For a short, I’d like to wait for the 480 area.

Result: Second trade came on QQQ 477 puts. While we did hold the first level of support, we created a lower low and I was thinking short on this play, risking highs. Nice first reaction for a solid trade.

Third trad came on QQQ 473 calls as we broke first level with speed and distance, got half way to next trigger which is where I started. I do this often, splitting levels and starting with smaller size. A nice buyers candle and I snagged it with again, a nice first reaction. This was morning lows….

Fourth trade came late morning on QQQ 475 calls with several minutes straight down from morning highs into valid support. While I do like being done early morning, I have been allowing myself some later trades with smaller size. It tests both patience for a high quality trade, and my ability to be in and out like usual. A nice Tuesday!

September 16

Stock charts provided by Tradingview.com

Entries charts provided by IBKR.com

Trades Taken: 4

SPY

Plan: A gap up in premarket, then steady downtrend. For SPY, I like playing a few gaps. 559 gap long, 563.68 short risking into ATH gap, starting at Friday’s highs. The reset for the long at the moving averages would be nice as well.

While we are under the previous close and that is a short I would normally take, I like the extension better, plus QQQ would not be at previous close at the same time. This attention to detail is paramount when selecting trades to prepare for. Learn to see if the markets align with each other.

Result: Third trade of the day came on SPY 565 puts. I used a further strike due to the risk I had to accept on this one. I entered on extension (after we broke through previous close, and got half way to trigger point). An all in, all out trade as again, first reaction is so predictable. Check out the next trade, flipping long on a remount trade.

Fourth trade came on SPY 562 calls on the remount of previous close (yellow line). This was not a trade marked prior to open, but remounts will present themselves as data (time) moves on. I didn’t snag the bottom on this one, but another solid trade in the books on first reaction.

QQQ

Plan: QQQ long will be all about moving averages. This is, as of now at 6:07, my favorite trade. Massive gathering of moving averages. If we dip out of the gate with enough distance to them, I would be surprised if it didnt give an opportunity. For a short, 475, but the risk is wide into 478. I like qqq long on a morning move.

I don’t often highlight trends, but this one is hard to ignore. It can be seen in many other stocks as well if you look. Technically, QQQ tested on Friday. A move down over the next few days (this is an IF scenario) it would appear the trend worked well. A blast above trend on the other hand can be just as volatile.

Result: First trade of the day came on QQQ 470 calls as we dipped into moving averages. I used more size on this one, starting a tad early, I felt the discomfort even though we tested the level perfect. I did not average properly on this one, hesitating right at level for a perfect add, but still managed a very nice green trade. Check out the entries chart, that green line is my average, not my best work. A lot to improve on this one with emotions regarding size. This is a major focus for me as I continue to work on my game.

Second trade on the came gives me MY FIRST RED TRADE OF THE MONTH. I took QQQ 473 puts with the idea of risking into highs. I quickly realized this was not he trade I wanted, I actually wanted the short on SPY. I quickly got out (red after paying myself on first push) and switched to SPY short as you will see. A papercut, but I’m actually glad I got a red trade out of the way and stopping out when I realized it wasn’t my trade.