December 20

Stock charts provided by Tradingview.com

Entries charts provided by IBKR.com

Trades:

Trades Taken: 1

Trade Plan

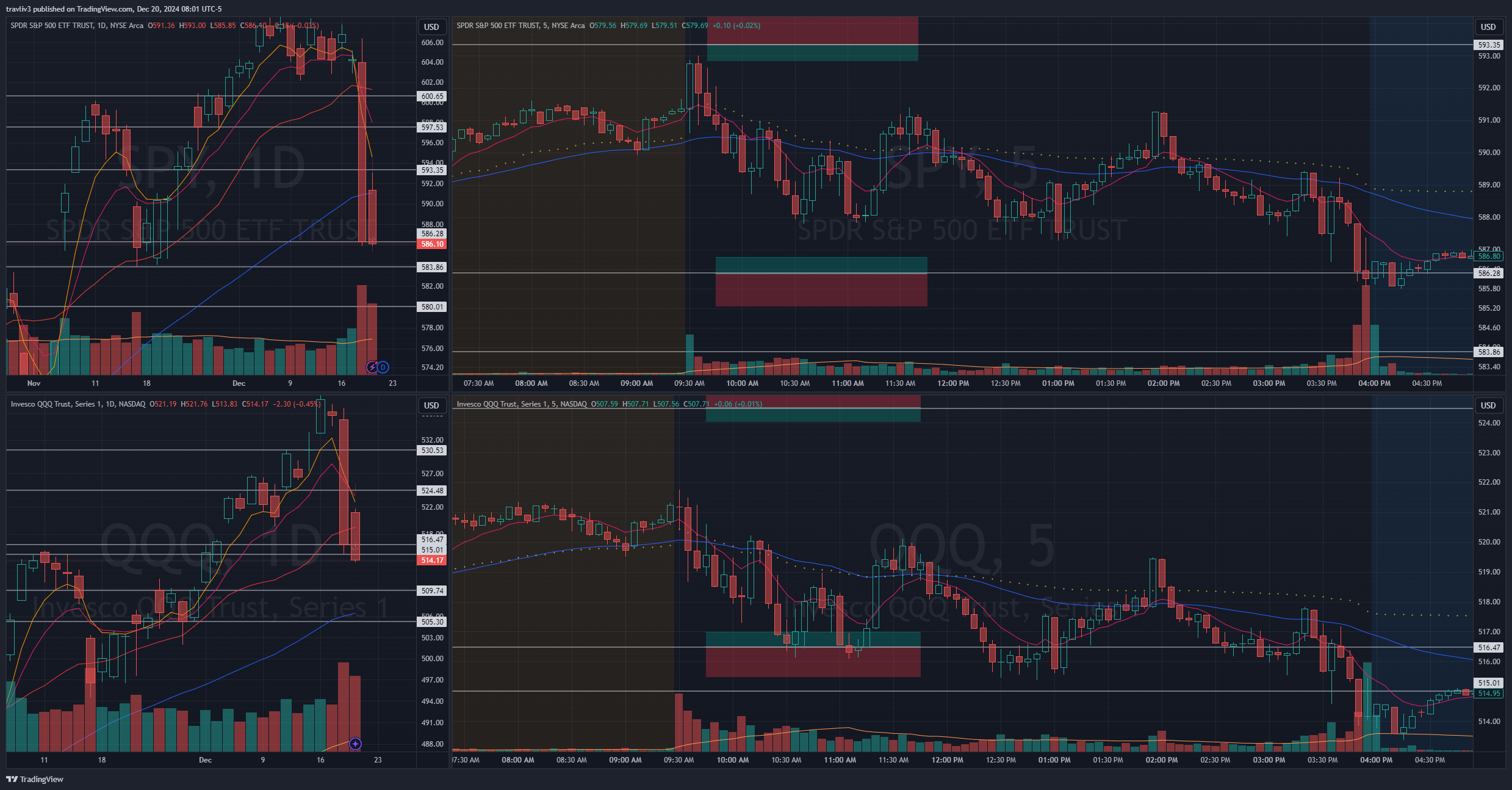

Plan: Very clean trading yesterday. A large gap down this premarket, with a decent bounce, setting us up smack in the middle of levels at 9:00. Interested in a short for either market if we push into yesterday’s close. Both have gap fills lower for a long if we dip. Should get decent range on this Friday after a volatile week. Again, looking to capitalize on the first directional pick.

Result: Markets start the morning with a push out out of the gate. Neither went far enough for full entry, but I did get a starter on SPY 586 puts and got first target just 15 second later!?!?! Doesn’t look like much, but that’s a 12% move into the 9 ema on the 1 minute chart. I’m even happier with patience on entry, and was rewarded for the entry. Here we are at 10:00 est without a proper trigger, and I’m green. How? FIRST DIRECTONAL PICK is a big part of the game on a large gap. But like every day, we move towards resistance, I look for a short/puts. If we move towards support, I look for a long/calls. Remove a lot of the thinking and stick to strategy and plan, and then it’s all about controlling fear and greed.

Being 5 for 5 this week is what I’m most focused on. A very volatile week in the markets with FOMC creating a large move. I stayed disciplined with first test prior to 10:00 and carry on with my day. Confidence in a volatile market does wonders for a trader’s psychology. My job is to capitalize on the first move, first trigger of the day. My job IS NOT to catch every move.

December 19

Stock charts provided by Tradingview.com

Entries charts provided by IBKR.com

Trades:

Trades Taken: 1

Trade Plan

Plan: Morning session yesterday was very clean. FOMC really rocked the market, seeing a very sharp decline into close. A bounce in premarket this morning, not so far fetch after such a large sell off. I like 593 area for SPY if we pop at the open, then eyeing the 5 and 9 ema which should be around 597.50. Previous close on SPY and two more lower levels marked. QQQ I like moving averages for the short which also lines up with end of day VWAP. Previous close long lines up nice on 516 range. Should be an interesting morning following yesterday’s volatile action.

When the trade boxes (red and green area on intraday chart) look very small, that means volatility has picked up. Moving faster and harder, which equates to closer levels, even when valid, having a higher chance of not being respected for a reaction. My answer to that is to size down. I am aware the risk is there, look for the slap you in the face trade, and accept the outcome.

Result: SPY pushed first few minutes, I went with SPY 594 puts for a fantastic first reaction, nailed opening highs within pennies, again resulting in a profitable trade within minutes. Nailing pivot areas for first reaction is what I do!

December 18

Stock charts provided by Tradingview.com

Entries charts provided by IBKR.com

Trades:

Trades Taken: 1

Trade Plan

Plan: A decent gap up this morning, which turned around at 8:30 numbers, sending both markets back down by 9:00. FOMC at 2:00 est today, so a big move is expected per usual. Looking to capitalize on the first move of the morning if we test a valid level with distance. QQQ 533 area for a long, same as yesterday, with a reset down at gap fill of 530.53. The short on QQQ is 538 gap into ATH. SPY tested previous close around 9:00 with the sell off. Still a valid level if enough distance, could very well serve as a headbump short (failure of level) if we open or go below it during the session. Lower levels long for SPY are the 20 ma and 600 area retest.

Result: A heavy first minute on QQQ catches my attention as it went towards long entry area. Dip in the morning towards a long level means I go with calls. I averaged in on QQQ 533 calls and proper averaging allows me to be green almost instantly. Great first read on the market and again the plan works with a first reaction. Levels and understanding of the market needs to be bulletproof in order to trust the trade.

Hindsight is always 20/20. One can go back and look and say “man you should have held, it ran for a huge win!”, or “you shouldn’t have taken that trade”. Maturing in your trading is realizing it’s not about being right or wrong, or catching a huge win. It’s about stacking base hits and controlling your emotions when at war with yourself. This is my key to building confidence, which then allows you to scale up on your strategy.

December 17

Stock charts provided by Tradingview.com

Entries charts provided by IBKR.com

Trades:

Trades Taken: 1

Trade Plan

Plan: A gap down this morning. SPY 602.80 area for a long, 20 ma for a reset trade if it breaks. SPY short is previous close, but moving averages may get in the way this morning for a quick short, we’ll see. QQQ short at previous close is on deck, 533 area for the first long, lower level longs are more interesting but likely won’t test in the time frame I watch.

Result: Market with a dip out of the gate. Entered on SPY 602 calls wanting it lower into levels. One round of buys, one round of sells here for as I stay disciplined with first target and sell into high of day for a +10% move in one minute. This month is all about executing the plan, and getting first target. Remember, my goal is to stack base hits, to consistently pull the trigger to plan on both the entries and exits.

December 16

Stock charts provided by Tradingview.com

Entries charts provided by IBKR.com

Trades:

Trades Taken: 1

Trade Plan

Plan: A pretty clean week last week. A gap up this morning coming into 9:00 am. A gap fill around 607.50 starts the short interest on SPY, with a dip into moving averages for a long with previous close within risk. QQQ is testing Friday’s highs in premarket as I write this, not much interest on a short with QQQ, but I do like previous close for a long and 526.50 gap fill for a reset long. Overall the best setup is SPY.

Result: SPY with a slight dip in first several minutes, QQQ was holding Friday’s highs. I went with SPY 604 calls with a starter, then fixed the average. Didn’t get the further extension down with speed and distance I was looking for, but still played the game of peaks and valleys here for a nice base hit to start the week. That’s all this really is, a game of peaks and valleys at proper areas. Learn to know where the game is played, and learn how to stack base hits.